Company Director Disqualification (Updated 2026 Guide)

- Over 30 years' experience

- Protect your director status

- Avoid a lengthy ban

Company Director Disqualification (Updated 2026 Guide)

Director disqualification - Introduction

Receiving a Section 16 letter can be unsettling. It signals a formal investigation by the Insolvency Service into your conduct as a director. Your actions in the next few days are crucial.

A director’s disqualification can cause serious damage. It affects your livelihood and can stop you from holding positions of responsibility for many years

This guide explains how director disqualification works. It outlines what it could mean for you and the immediate steps you should take to protect your future.

- What is director disqualification?

- How long can a director face disqualification?

- How many company directors are disqualified each year?

- The purpose of director disqualification

- What disqualifies you from being a director?

- What constitutes “unfit conduct” by a director?

- What to do if you are facing director ban?

- 5 Step director disqualification process

- Company director disqualification - FAQ’s

- What are the consequences of acting as a director whilst disqualified?

- Director duties and director disqualification

- Call our director disqualification solicitors

What is director disqualification?

Director disqualification is a legal process that prevents a person from being a company director for a certain time. This usually follows an investigation that finds evidence of “unfit conduct”.

Key facts about director disqualification:

- Purpose. The main goal of director disqualification is to protect the public and business community from harm.

- Ban Durations. Disqualification periods range from 2 to 15 years, depending on how serious the conduct is.

- Common Reasons. Unfit conduct includes fraud, wrongful trading, insolvency, or other serious misconduct.

How long can a director face disqualification?

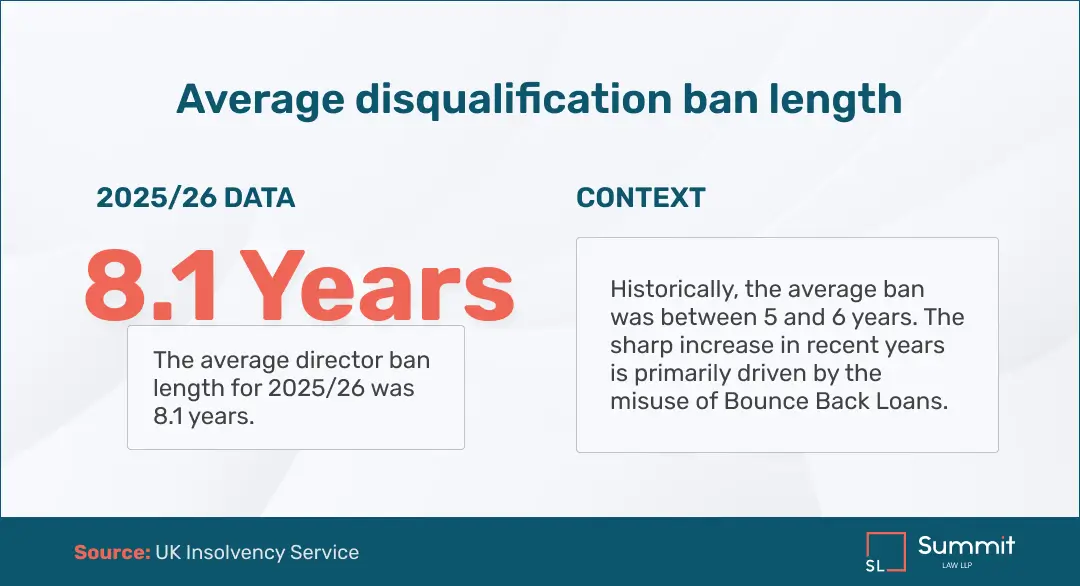

The Insolvency Service can disqualify a director for between 2 to 15 years. The disqualification time limit depends on the seriousness of the conduct. In 2025/26. the average director ban duration was 8.1 years.

Courts typically categorise bans into three brackets:

- 2-5 years (usually for reckless or negligent conduct as a director)

- 6-10 years (usually for serious misconduct which is more detrimental to the public interest)

- 11-15 years (for the most severe breaches, usually fraudulent or otherwise serious/criminal behaviour.

How many company directors are disqualified each year?

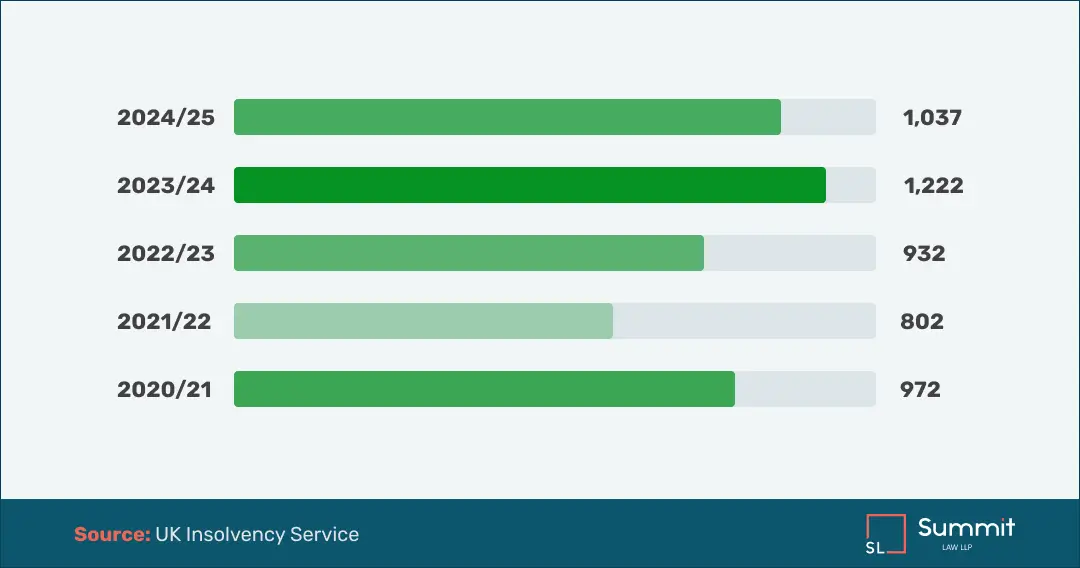

In 2024/25, the Insolvency Service disqualified 1,037 company directors. Of these, 736 bans were for bounce back loans (BBL) misuse.

As illustrated in the graphic below, the number of disqualified director cases have risen since 2020, mainly linked to misuse of government support schemes.

Total director disqualifications by year: 2020/21 = 972, 2021/22 = 802, 2022/23 = 932, 2023/24 = 1,222, and 2024/25 = 1,037.

The purpose of director disqualification

Director disqualification is not just a punishment for past conduct. It also acts as a preventative measure to safeguard the public interest and maintain trust in the corporate system.

Director disqualification is designed to:

- Prevent directors who have shown themselves to be unfit from causing further harm

- Maintain business confidence by ensuring only those who meet proper standards of conduct can run companies in the UK

- Level the playing field so that directors who act dishonestly do not gain an advantage over compliant businesses

- Encourage good governance by reminding directors of their responsibilities and the personal consequences of ignoring them.

However, if you are facing director disqualification proceedings, you should not assume disqualification is inevitable. The Secretary of State must prove your conduct makes you unfit.

What disqualifies you from being a director?

Most director disqualifications happen after a company goes bankrupt. However, the Insolvency Service can also investigate directors for serious misconduct. Investigations can start from referrals. These can come from HMRC, trading standards, or the public.

The most common reasons for disqualification include:

- Company insolvency: When a company is placed into insolvency proceedings, the conduct of its directors is automatically reviewed.

- Bankruptcy: If you are made bankrupt, you are automatically disqualified from acting as a director or taking part in the management of a company.

- Misconduct or incompetence: This is the most common reason for a director ban. In many cases, it occurs when the director is not competent enough to meet their legal obligations.

- Fraud and serious wrongdoing: Where there is deliberate abuse, such as tax evasion, wrongful trading, or criminal conduct, disqualification is almost certain.

- Public interest winding-up order: This allows the Secretary of State to petition the court to wind up a company where it is considered in the public interest.

What constitutes “unfit conduct” by a director?

The Company Directors Disqualification Act defines “unfitness” in broad terms.

Examples of unfit conduct include:

- Allowing a company to continue trading when it cannot pay its debts

- Not keeping proper company accounting records

- Not sending accounts and returns to Companies House

- Not paying the tax owed by the company

- Using company money or assets for personal benefit

- Matters of public interest (usually severe cases)

- Fraudulent or dishonest dealings.

What to do if you are facing director ban?

Receiving a Section 16 letter confirms you are under investigation and at risk of director ban. This letter outlines the specific allegations of unfit conduct against you. Your response in the following days and weeks is crucial. Early action gives you the best chance of reducing or avoiding disqualification.

You must act decisively by:

- Read the letter carefully: Note the specific allegations being made against you and the time limit for your response.

- Seek advice early: The sooner you understand the strength of the case against you, the better positioned you are to make an informed decision.

- Gather evidence: Collect company records, correspondence, financial statements, and anything else that helps explain or justify your conduct.

- Consider options: You have the option to contest the claims, negotiate a settlement, or propose a disqualification agreement to bypass court expenses.

- Do not ignore deadlines: Failing to respond in time can increase the risk of a more extended disqualification period or additional penalties.

5 Step director disqualification process

The director disqualification process typically involves five stages with strict deadlines. Once proceedings begin, the outcome can have lasting consequences for your career. Understanding these steps and preparing your response early gives you more options to protect your position.

Director Disqualification Process: The process typically follows a 5 stage process, though many cases settle at Stage 4 (Undertaking) to avoid Court Proceedings (Stage 5).

Steps in Detail:

- Investigation: The Insolvency Service reviews conduct.

- Notification: Director receives a ‘Section 16’ letter.

- Response: Director submits representations to dispute findings.

- Undertaking: Voluntary agreement to ban (avoids court costs).

- Court Proceedings: Legal action if no undertaking is agreed.

Investigation

The Insolvency Service or another regulator gathers evidence about your conduct. This might include reviewing company accounts, correspondence, decision-making records, or witness statements. Investigations can take place even if your company is solvent, for example, if there is alleged fraud or breach of competition law.

Notification

You will typically receive a Section 16 letter setting out the allegations against you and the length of disqualification sought. This letter is your opportunity to respond before formal court proceedings are issued.

Response

You will have a set deadline to reply. Failing to respond in time can limit your options.

At this stage, you can:

- Defend the allegations in full with evidence

- Make representations to narrow or challenge the case

- Negotiate the terms or length of any proposed disqualification

Disqualification undertaking

Instead of going to court, you may agree to a disqualification undertaking, voluntarily accepting a ban for a fixed period. This avoids the cost, stress, and publicity of a contested court case, and may allow you to negotiate a shorter period.

Once given, an undertaking has the same effect as a court order and cannot easily be undone. As such, professional advice from director disqualification lawyers is strongly recommended before agreeing to an undertaking.

Court proceedings

If no undertaking is agreed, the Secretary of State (acting through the Insolvency Service) can apply to the court for a disqualification order. The Official Receiver may also be involved where a company has gone into compulsory liquidation.

If you choose to defend the proceedings, the court will consider all the facts and circumstances to decide whether your conduct makes you unfit to be a director.

If the court does issue a disqualification order, you will usually have to pay the costs and expenses incurred by the other parties involved.

Company director disqualification - FAQ’s

How many directors get disqualified each year?

The Insolvency Service regularly publishes data on company director disqualification. The latest statistics published highlight the following key trends:

- The Insolvency Service disqualified more than 1,000 directors in 2024-25

- The average length of a ban was eight years, showing how severe penalties can be

- Key reasons for director disqualification included failing to maintain adequate accounting records, not paying tax or VAT that is owed to HMRC and securing a Covid Bounce Back loan they were not entitled to

- Of those banned in 2024-25, 736 were banned for Covid loan abuse.

What happens if you are disqualified as a director?

You cannot act as a director or be involved in company management for the disqualification period (unless you get approval from the court). Breaching this is a criminal offence.

When can a director be disqualified?

Disqualification usually follows an investigation by the Insolvency Service, often after insolvency proceedings, but it can also arise from referrals by HMRC, other regulators, or as a result of criminal convictions.

Can a disqualified director be a designated partner in an LLP?

In the UK, a disqualified director cannot be a member of an LLP without court permission.

Am I personally liable for a Bounce Back Loan?

Personal guarantees were not allowed for Bounce Back Loans. However, you may face liability if the loan was misused or obtained fraudulently.

Can a disqualified director be a director in another company?

No. Disqualification applies to all UK companies, and also to overseas companies trading in the UK.

Can a disqualified director be a shareholder?

Yes, you can still hold shares in a company. But you cannot be involved in its management without court permission.

How to check if a director is disqualified?

The Companies House register lists all disqualified directors. Details are removed once the disqualification period ends.

What disqualifies you from being a company director?

Common reasons include allowing insolvent trading, failing to file accounts, misusing company assets, not paying tax, or committing fraud.

Why would a director be disqualified?

Directors are disqualified for a range of reasons, including misconduct, incompetence, insolvency-related breaches, bankruptcy, or criminal acts such as fraud.

What are the consequences of acting as a director whilst disqualified?

The consequences of acting as a director whilst disqualified are severe. The penalties can result in imprisonment, fines, and personal liability for company debts.

The main penalties for breaching a disqualification order include:

- Criminal Prosecution. Acting while disqualified is a criminal offense that can lead to up to two years in prison, a fine, or both.

- Personal Liability. You can be held personally responsible for company debts incurred while unlawfully involved in management.

- Compensation Orders. You may be ordered to pay credits for losses caused by your unlawful conduct.

- Extended Ban. The court may extend your disqualification period if you breach the order.

- Reputational Damage. A prosecution can ruin your professional standing. It often deters banks, investors, and future business partners from working with you.

Director duties and director disqualification

Failure to uphold your legal responsibilities as a company director serves as the primary ground for disqualification proceedings. The Insolvency Service will examine whether you met the standards expected of your role or if your actions fell below the required level of competence.

Key director duties include:

- Duty to maintain books. Failing to keep accurate records often leads to disqualification.

- Duty to pay taxes. Failing to pay company taxes or prioritising other creditors often results in disqualification.

- Duty to act in the company’s best interests. Using company funds for personal gain or harming creditors can lead to disqualification.

- Duty to exercise reasonable care. Failing to meet this standard can lead to disqualification.

- Duty to avoid conflicts of interest. Failing to declare or manage conflicts can lead to disqualification.

Call our director disqualification solicitors

- Expert advice: We provide clear, practical guidance from the very first step.

- Proven results: We have successfully persuaded the Insolvency Service to withdraw claims, securing shorter bans, or avoiding disqualification altogether.

- Commercial approach: Where appropriate, we can seek the court’s permission for you to undertake prohibited activities.

- Competitive fees: We offer initial advice for a competitive fixed fee. Should you require legal support beyond this, we provide tailored fixed fee estimates.